MaaS vehicle needs, time to market, and future car materials

Megacities & MaaS will influence the majority of car designs. The needs of megacities — along with future mobility providers and their alliances with automakers — will determine the majority of future vehicle designs as Mobility as a Service (MaaS), and then autonomous MaaS, takes hold.

We consider this megacities-as-main-drivers trend inevitable given that, by the year 2050, 90+ megacities will be home to two-thirds the world’s population and the majority of world’s Gross Domestic Product.

This population growth will undoubtedly motivate megacities to embrace new, innovative approaches to mobility to address the following already pressing problems:

- Traffic gridlock

- Debilitating air pollution

- Lack of parking

- And all of dangers related to climate change: rising oceans, extreme weather, etc.

Many megacities have been on the vanguard in taking climate-positive actions, and observers expect this trend to accelerate as the ever-increasing number of cars make city life less and less livable.

Of course, public transportation — both traditional and new experiments, such as Hyperloop — will be fully leveraged. However, public transportation’s inherent limitations are well known:

- “First mile, last mile”: not everyone lives and works within walking/biking distance of public transportation.

- Extending subways and trains in existing neighbors is extremely expensive and time-consuming.

- Buses, in all shapes and sizes, including express buses, will be more fully utilized and integrated. But buses have their own challenges: the number of feasible routes, frequency, cost, transport speed, etc.

Ride hailing and, to a lesser extent, car sharing have already helped close the “first mile/last mile” gap. But many experts believe that autonomous MaaS could be the ultimate key to a fully e-integrated mobility ecosystem for virtually all urban dwellers.

The design challenges of MaaS vehicles

Common criteria for Mobility as a Service vehicles can be outlined as follows:- Easy and fast vehicle access through innovative entrance systems, such as sliding doors, even on small cars.

- Variable seating configurations, including seats that face each other and “mobile office or mobile infotainment” arrangements for autonomous vehicles.

- Maximized interior space utilization for more riders or delivery goods, incorporating pillarless and hatchback designs, as well as reduction in the size of the front end.

- At the same time, minimizing exterior size/length for more efficient maneuverability and parking.

- Increased hygiene inside the car, using hard-to-get-dirty surfaces that are easily cleaned.

- With quiet EV drivetrains, increased focus on travel comfort including airborne, roadborne, and structural noise, vibration, and harshness (NVH).

- Leveraging function integration as a common approach for structural challenges; for example, the EV battery enclosure as the basis of the car’s structure.

- And future mobility providers’ key focus on lower Total Cost of Ownership (TCO), which includes vehicles designed for easier repairs and streamlined maintenance.

The business challenges of MaaS vehicles

New forms of MaaS and the inevitable autonomous MaaS have created the following game-changing challenges for automakers:

- Very large investments in research and development — and not merely on new drivetrains for battery EVs, fuel-cell EVs, and plug-in hybrid EVs. As concept car designs show us, autonomous MaaS vehicles may have very different profiles from today’s vehicles, requiring significant R&D.

- Potentially major investments in new production equipment for autonomous MaaS vehicles.

- And, on the business side, responding to the fact that numerous new, large investors are excepting relatively fast returns on their investments.

All three of the above factors make time-to-market for autonomous MaaS vehicles a critical goal.

In response to these pressures, automakers have created their own MaaS ventures as well as making numerous alliances with future mobility providers.

The new ecosystem even produces the likely scenario of rather few specific physical platforms, shared between multiple future mobility providers…and even other automakers. The benefit of fewer vehicle platforms is, of course, in realizing higher production levels faster, which enables economies of scale which, in turn, allows for faster returns on investments.

Time to market, existing familiarity, & economics will help drive decisions on vehicle material selection

Materials used in these shared platforms will need to be optimized for production so they can compete in mass volume markets.

New, alternative materials for these platforms are at a distinct disadvantage in this race: they demand steep learning curves from automakers; they have limited material availability/volume; and they require new engineering to develop new processes for producing car components.

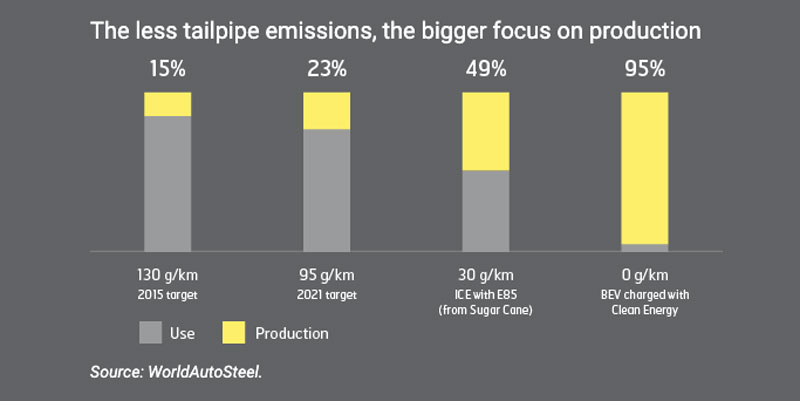

Materials such as carbon fiber reinforced plastics (CFRPs), magnesium, and aluminum also have a much larger carbon emissions during material production than advanced high strength steel (AHSS). As drivetrains — driven by mandates from the megacities — go electric and their sources of electricity/hydrogen turn to renewables, emissions from tailpipes will drop and much more attention will be paid to emissions during a vehicle’s production: that is their total Life Cycle Assessments (LCAs). Which also includes their ability to be readily recycled.

An example of the above inevitabilities is Volkswagen’s ID.3 Neo. The ID.3 is one of five new Volkswagen Group models based on its MEB platform: Modularer E-Antriebs-Baukasten, or Modular Electric Drive Matrix. According to VW’s chief development engineer for electric vehicles, the ID.3 Neo is “99% steel.” And VW offers the MEB platforms — one for passenger vehicles, one for cargo loads — to competing automotive OEMs.

Conclusions for auto designers

While the overarching trends in future mobility appear to becoming clearer, the details are always difficult to predict. For example, what is the timeframe for the developments listed here? No one know for sure.

But the old adage of “follow the money” — that is, investors and their investments — still applies. Investors realize that megacities and future mobility providers will need for forge alliances to quickly address traffic gridlock, air pollution, climate change, and even parking problems.

And as pressure builds to rapidly deploy MaaS and autonomous MaaS solutions for megacities’ mobility problems, automotive designers will depend heavily on new, innovative designs using AHSS or AHSS/hybrid materials.

Why AHSS? Because virtually all vehicular structural challenges for the coming wave of MaaS vehicles can be met — today — using cost-effective, readily scalable AHSS solutions that use forming processes that are familiar to today’s automakers.