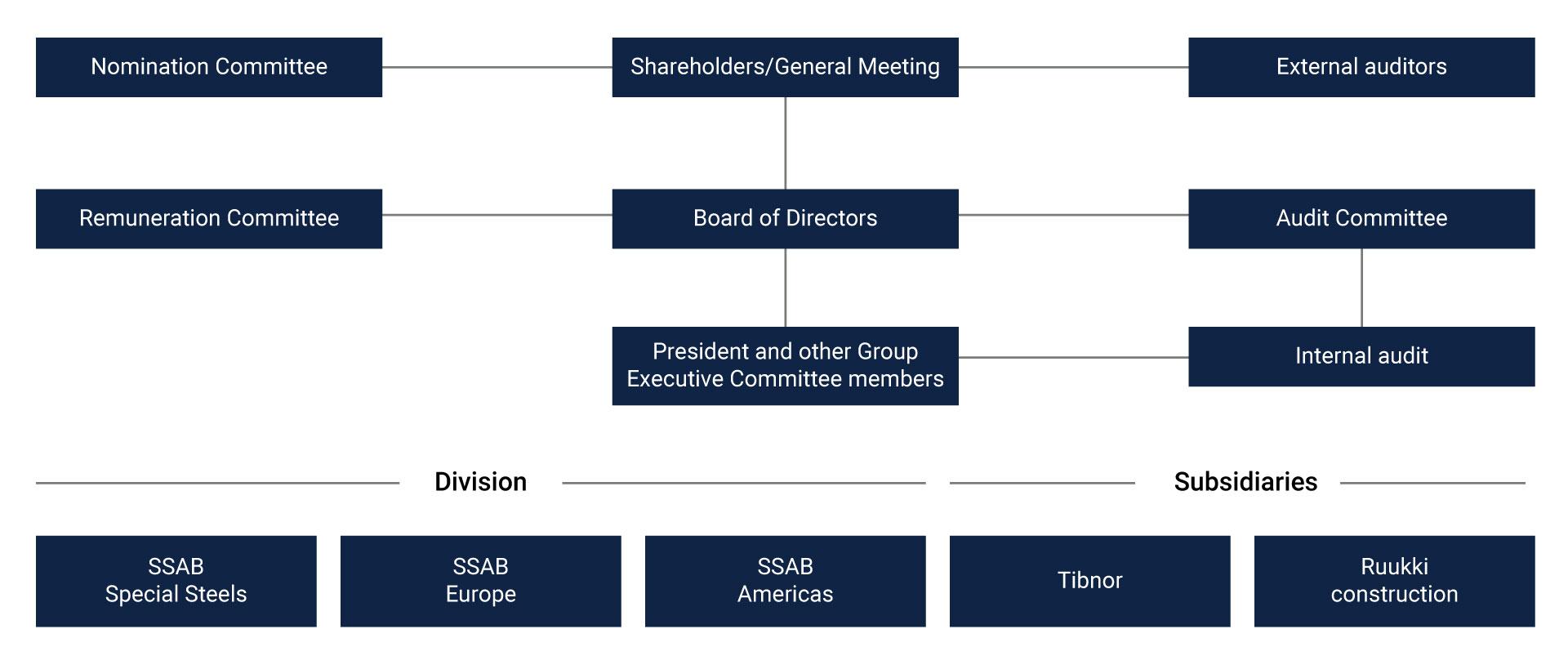

Corporate governance

SSAB is listed on Nasdaq Stockholm, and is subject to its rules and regulations, and also applies the Swedish Corporate Governance Code (the Corporate Code). SSAB has a secondary listing on Nasdaq Helsinki.

The Board of Directors